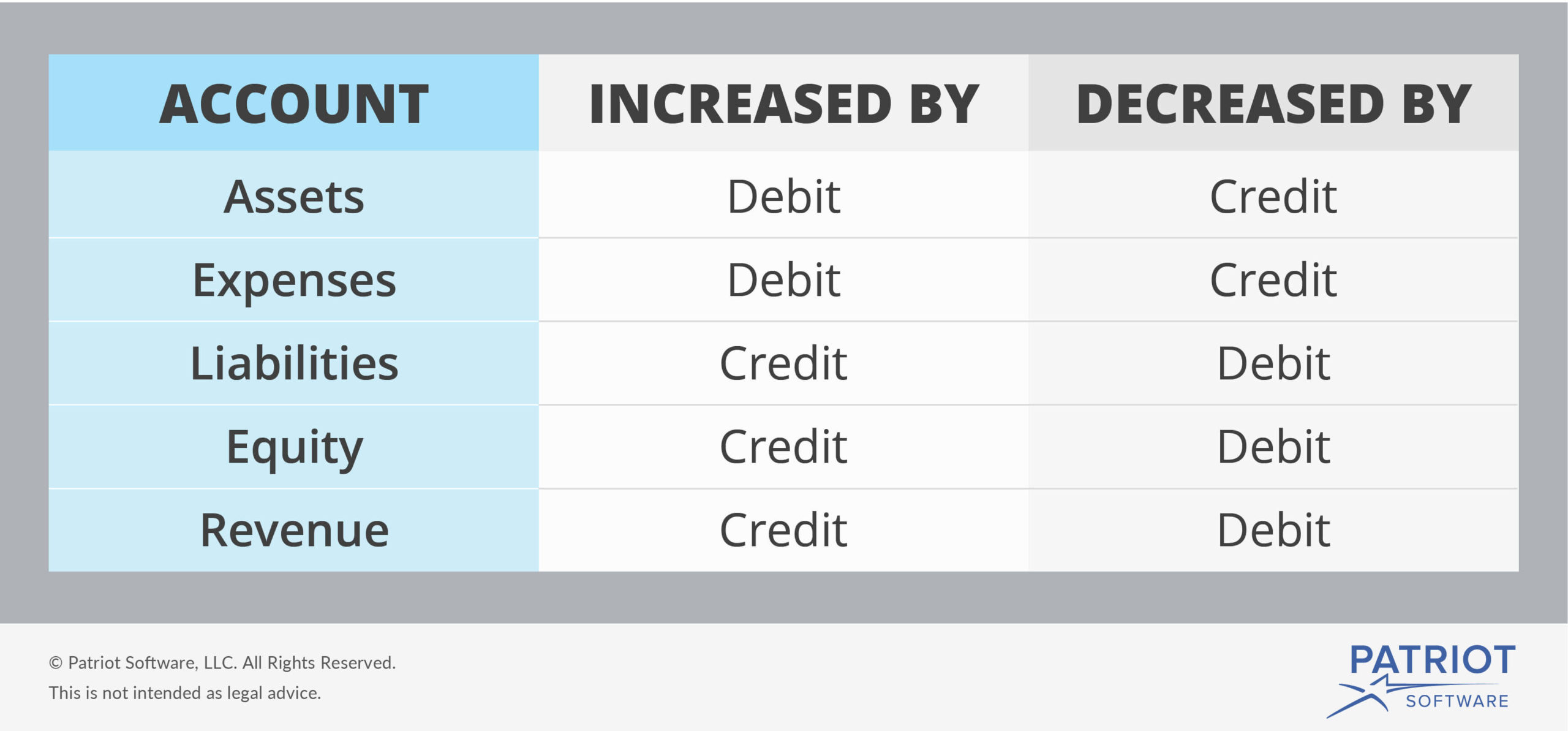

Indian merchants had developed a double-entry bookkeeping system, called bahi-khata, predating Pacioli's work by at least many centuries, and which was likely a direct precursor of the European adaptation. This system is still the fundamental system in use by modern bookkeepers. Pacioli devoted one section of his book to documenting and describing the double-entry bookkeeping system in use during the Renaissance by Venetian merchants, traders and bankers. The first known recorded use of the terms is Venetian Luca Pacioli's 1494 work, Summa de Arithmetica, Geometria, Proportioni et Proportionalita ( A Summary of Arithmetic, Geometry, Proportions and Proportionality). In some systems, negative balances are highlighted in red type. When a particular account has a normal balance, it is reported as a positive number, while a negative balance indicates an abnormal situation, as when a bank account is overdrawn. When the total of debits in an account exceeds the total of credits, the account is said to have a net debit balance equal to the difference when the opposite is true, it has a net credit balance.ĭebit balances are normal for asset and expense accounts, and credit balances are normal for liability, equity and revenue accounts. Despite the use of a minus sign, debits and credits do not correspond directly to positive and negative numbers. Only one subtraction is needed, simplifying calculations before the availability of computers.Īlternately, debits and credits can be listed in one column, indicating debits with the suffix "Dr" or writing them plain, and indicating credits with the suffix "Cr" or a minus sign. The account balance is calculated by subtracting the smaller total from the larger total. First the debit column is totaled, then the credit column is totaled. The use of separate columns simplifies calculation of the balance for the account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited.ĭebits and credits are traditionally distinguished by writing the transfer amounts in separate columns of an account book. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account.

Each transaction transfers value from credited accounts to debited accounts. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions.

0 kommentar(er)

0 kommentar(er)